The mkt is at the point whereby technicals mean NOTHING. We could see days of 300, 400, 500 etc points drop or rally on the Dow till a few days after this Debt Limit crap gets resolved (or not) before a return to normalcy. Normally I don't care about news because the market doesn't care about it. But once in awhile the market focuses only on news and technicals mean absolutely nothing (and ALL indicators become USELESS). That is where we are now.

The strong volatility in the market the past few days is an indication that market is now getting worried about the Debt talks in Washington as the deadline approaches (which wasn't the case before, as the market was anticipating a solution as both sides come together. Opposite is the case at this time as both sides seem to be moving further apart while they come on TV and say things will be resolved. Talking the talk but not walking the walk. At this point the market is tired of the TALK and wants the WALK, hence the pickup in volatility).

VIX is significantly above it upper Bollinger Band (BB) at this time (see my VIX chart). In an ideal environment, this will indicate a reversal back down for the VIX (and rise for the mkt). But in the current environment, the VIX can double, triple, quadruple etc from here, regardless of the BB as fear level rises due to uncertainty caused by the useless congress.

The market remains bullish longterm based on my technicals. But technicals are about to become useless if this Debt talk is not resolved. I positioned myself by buying Out-of-the-Money (cheap) VIX Calls (based on news) while long the SPX (based on technicals) just in case the market collapses. So i'm trading based on news and technicals.

I don't care about politics for exactly what is happening in Washington now. I hope they get their act together and get off the screens and every website and stop messing up the market/charts. Congress is now a virus on my computer because I see Debt Limit crap everywhere. Congress should pay their bills just like everyone does. I NEVER knew paying bills was debatable (thanks to congress, i will stop paying my bills so that I can help congress send US and the world into greatest depression (not great depression) caused by US politicians). What a joke.

SPX-WEEKLY

SPX-DAILY

SPX-30MIN

SPY(SPX)-DAILY

VIX

UKX(FTSE)-WEEKLY

UKX(FTSE)-DAILY

FXE(EURO)-WEEKLY

FXE(EURO)-DAILY

UUP(DOLLAR)-WEEKLY

UUP(DOLLAR)-DAILY

USO(CRUDE)-DAILY

Enlarge any chart by clicking on it.

Unless otherwise specified, ALWAYS use the 15min chart to enter my recommended plays because

CONFIRMATION is a MUST. In other words, you need to see a 15min candlestick that CLOSES beyond

the entry point, then enter when it moves 10cents after the high/low of that candlestick.

Unless otherwise specified, ALWAYS use the 15min chart to enter my recommended plays because

CONFIRMATION is a MUST. In other words, you need to see a 15min candlestick that CLOSES beyond

the entry point, then enter when it moves 10cents after the high/low of that candlestick.

Saturday, July 30, 2011

Thursday, July 28, 2011

Wednesday, July 27, 2011

SPX-DAILY, SPX-30MIN, FXE (EURO), UUP (DOLLAR)

For the 3rd day now, I'm not able to get data on the UKX(ftse) on my trading software. I don't know what is going on with Ameritrade.

SPX-DAILY

SPX-30MIN

FXE(EURO)

UUP(DOLLAR)

SPX-DAILY

SPX-30MIN

FXE(EURO)

UUP(DOLLAR)

Tuesday, July 26, 2011

Monday, July 25, 2011

SPX-DAILY, SPX-30MIN, FXE (EURO), UUP (DOLLAR), FDX

I don't have the chart of UKX (ftse) because today's data is not showing up on the chart. I don't know if the symbol was changed or technical issues. I'll have to look into it at TdAmeritrade (my broker). The chart will be posted as soon as today's data becomes available.

FOR TUESDAY:

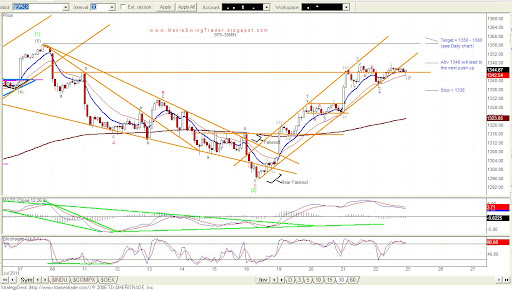

The SPX-30min chart is in a Bull Flag pattern. Also, there is an Inverted Head and Shoulder forming (still early at this time as it still needs to complete the right arm of the right shoulder). A move above 1345 will break out of the Bull Flag and the neckline of the Inverted HS thereby result to a push higher. So look for a trade above 1345 as the breakout point.

SPX-DAILY

SPX-30MIN

FXE(EURO)

UUP(DOLLAR)

FDX(FEDEX)

FOR TUESDAY:

The SPX-30min chart is in a Bull Flag pattern. Also, there is an Inverted Head and Shoulder forming (still early at this time as it still needs to complete the right arm of the right shoulder). A move above 1345 will break out of the Bull Flag and the neckline of the Inverted HS thereby result to a push higher. So look for a trade above 1345 as the breakout point.

SPX-DAILY

SPX-30MIN

FXE(EURO)

UUP(DOLLAR)

FDX(FEDEX)

Saturday, July 23, 2011

SPX, UKX(FTSE), VIX, FXE(EURO ), UUP (DOLLAR), USO (CRUDE).

The dollar (UUP) broke key support on Wednesday and it's poised to move much lower. Euro (FXE) is currently at key resistance. A breakout higher will lead to much higher prices. So it's very likely we will see much higher prices in the SPX (and indexes), but at this time, I need to see a move of the SPX above 1360 to be sure of much higher prices to come.

Fill your gas tank if USO (crude) trades above 39.15 because we will see higher prices at the pump that will be reflected 3days later and will keep going up for the next 1-3weeks depending on how fast USO gets to 42-43 before price at the pump starts dropping ;=).

FOR MONDAY:

If SPX moves above 1348 we will see prices rise as high as 1356-1360 for the day. If this happens too fast (in the early hours), then we will most likely see a pullback in the 2nd half of the day (going into the close). But if we see a steady rise from the open, then expect the SPX to close at the highs (1356-1360 or higher).

SPX-WEEKLY

SPX-DAILY

SPX-30MIN

UKX(FTSE)-WEEKLY

UKX(FTSE)-DAILY

VIX-DAILY

FXE(EURO)-WEEKLY

FXE(EURO)-DAILY

UUP(DOLLAR)-DAILY

USO(CRUDE)-DAILY

Fill your gas tank if USO (crude) trades above 39.15 because we will see higher prices at the pump that will be reflected 3days later and will keep going up for the next 1-3weeks depending on how fast USO gets to 42-43 before price at the pump starts dropping ;=).

FOR MONDAY:

If SPX moves above 1348 we will see prices rise as high as 1356-1360 for the day. If this happens too fast (in the early hours), then we will most likely see a pullback in the 2nd half of the day (going into the close). But if we see a steady rise from the open, then expect the SPX to close at the highs (1356-1360 or higher).

SPX-WEEKLY

SPX-DAILY

SPX-30MIN

UKX(FTSE)-WEEKLY

UKX(FTSE)-DAILY

VIX-DAILY

FXE(EURO)-WEEKLY

FXE(EURO)-DAILY

UUP(DOLLAR)-DAILY

USO(CRUDE)-DAILY

Thursday, July 21, 2011

SPX-DAILY, SPX-30MIN, FXE(EURO), UKX (FTSE)

Look for the rise to continue tomorrow if SPX trades above 1348 (which will most likely be in the 2nd half of the day).

SPX-DAILY

SPX-30MIN

FXE(EURO)-DAILY

UKX(FTSE)-DAILY

SPX-DAILY

SPX-30MIN

FXE(EURO)-DAILY

UKX(FTSE)-DAILY

Wednesday, July 20, 2011

Tuesday, July 19, 2011

Subscribe to:

Comments (Atom)