SPX-MONTHLY

SPX-DAILY LINE

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

Enlarge any chart by clicking on it.

Unless otherwise specified, ALWAYS use the 15min chart to enter my recommended plays because

CONFIRMATION is a MUST. In other words, you need to see a 15min candlestick that CLOSES beyond

the entry point, then enter when it moves 10cents after the high/low of that candlestick.

Unless otherwise specified, ALWAYS use the 15min chart to enter my recommended plays because

CONFIRMATION is a MUST. In other words, you need to see a 15min candlestick that CLOSES beyond

the entry point, then enter when it moves 10cents after the high/low of that candlestick.

Monday, January 30, 2012

Saturday, January 28, 2012

SPX - WEEKEND REVIEW

Reversal is looking imminent but I will not hold my breath till it actually takes place. But it's looking more likely as the indicators and price are starting to show signs weakness and imminent reversal compared to any time period since the current rally started about 6weeks ago.

SPX-WEEKLY

SPX-DAILY LONGER TIMEFRAME I

SPX-DAILY LONGER TIMEFRAME II

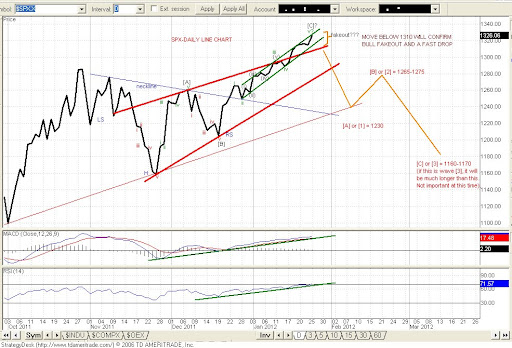

SPX-DAILY LINE CHART

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-WEEKLY

SPX-DAILY LONGER TIMEFRAME I

SPX-DAILY LONGER TIMEFRAME II

SPX-DAILY LINE CHART

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

Thursday, January 26, 2012

Wednesday, January 25, 2012

SPX - BULLS CONTINUE TO SHOW WHO IS IN CONTROL. CAN'T FIGHT THE MARKET.

While the bulls are still in control, the bears will take control in a ferocious way. The market will turnaround in a fast way with huge drops (the setup is in place). Though the indicators have been pointing to an imminent drop, the turn is yet to take place and you just can't fight the market. This is not market "manipulation" but the market doing what it does best i.e being irrational. The market can stay irrational longer than an investor can stay solvent.

SPX-DAILY LINE

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-DAILY LINE

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

Tuesday, January 24, 2012

Monday, January 23, 2012

Saturday, January 21, 2012

SPX WEEKEND UPDATE

While my charts and indicators have been pointing to a rollover (and continue to do so) over the past few weeks, it has resulted in a bear trap and tunnel vision by making me too focused on a downside reversal. As a result, I find myself making a long-term call rather than my usual swingtrade.

I have not been able to take advantage of the grind up or make an objective short-term decisions but instead focused on the long-term picture (Gambler's Fallacy).

I continue to expect a fast reversal downward that will take the SPX to about 1100. I strongly believe the current move up is a bull trap that will lead to a long reversal downward.

I will go back to posting quick swingtrade plays with Entry, Target and Stop Loss as they appear with a bearish long-term outlook.

Note: I'm not a bear (nor a bull), but I will like to see the market keep rising if that will mean a better economy since the market is a leading indicator. But I don't think that will be the case.

I just play the hand I'm dealt whether bullish or bearish.

SPX-WEEKLY

SPX-DAILY LINE

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

I have not been able to take advantage of the grind up or make an objective short-term decisions but instead focused on the long-term picture (Gambler's Fallacy).

I continue to expect a fast reversal downward that will take the SPX to about 1100. I strongly believe the current move up is a bull trap that will lead to a long reversal downward.

I will go back to posting quick swingtrade plays with Entry, Target and Stop Loss as they appear with a bearish long-term outlook.

Note: I'm not a bear (nor a bull), but I will like to see the market keep rising if that will mean a better economy since the market is a leading indicator. But I don't think that will be the case.

I just play the hand I'm dealt whether bullish or bearish.

SPX-WEEKLY

SPX-DAILY LINE

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

Thursday, January 19, 2012

Wednesday, January 18, 2012

SPX - JUST CAN'T FIGHT THE MARKET

While my indicators keep pointing to weakness and a reversal, the market has proven to be a force to be reckoned with. Though I still expect a strong reversal downward, I will just keep tracking till the ship finally makes the turn. Just can't fight the market for it is ALWAYS right. But I believe this grind up is a bull trap.

SPX-DAILY LINE

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

SPX-DAILY LINE

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

Tuesday, January 17, 2012

SPX - zzzzzzzzzz................

I guess you can't turn a ship on a dime. This ship is getting ready to turn. Downside coming. Just taking too long to play out.

SPX-DAILY LINE

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

SPX-DAILY LINE

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

Saturday, January 14, 2012

Thursday, January 12, 2012

SPX - BOOOOORRRRRIIIIIIINNNNNGGGGG. PUTTING ME TO SLEEP.

Based on the intraday (30MIN)charts, tomorrow is setting up for a big move (likely down based on my long-term expectation and daily chart). But the intraday charts are pointing to a big move in either direction. I will not hold my breath expecting a big move tomorrow because the lousy price action can continue especially given the fact that it's Friday.

It's about time to start seeing some big moves. I'm missing the high volatility of 2011 but it will come with a vengeance though it's acting like 2009 are the moment.

SPX-DAILY LINE

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

It's about time to start seeing some big moves. I'm missing the high volatility of 2011 but it will come with a vengeance though it's acting like 2009 are the moment.

SPX-DAILY LINE

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

Subscribe to:

Comments (Atom)