The charts are looking weak. This month could be a bloody one for the market with a sharp reversal. BE VERY CAREFUL (especially if you are bullish) because things are likely to change VERY FAST.

Check back over the weekend for any updates/additions.

UKX (FTSE)-DAILY

MA-DAILY

CRM-DAILY

AAPL-DAILY

Enlarge any chart by clicking on it.

Unless otherwise specified, ALWAYS use the 15min chart to enter my recommended plays because

CONFIRMATION is a MUST. In other words, you need to see a 15min candlestick that CLOSES beyond

the entry point, then enter when it moves 10cents after the high/low of that candlestick.

Unless otherwise specified, ALWAYS use the 15min chart to enter my recommended plays because

CONFIRMATION is a MUST. In other words, you need to see a 15min candlestick that CLOSES beyond

the entry point, then enter when it moves 10cents after the high/low of that candlestick.

Saturday, March 31, 2012

SPX WEEKEND REVIEW I

SPX-MONTHLY

SPX-WEEKLY

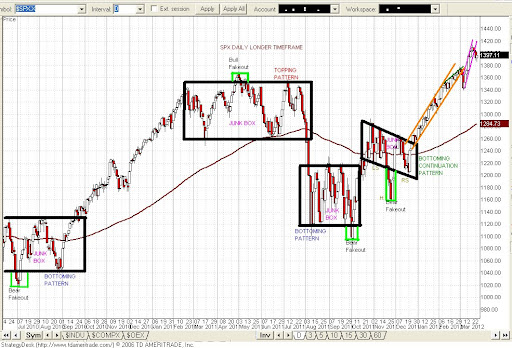

SPX-DAILY LONGER TIMEFRAME

SPX-DAILY LINE

SPX-DAILY I

SPX-DAILY II

SPX-DAILY III

SPX-30MIN LONGER TIMEFRAME

SPX-5MIN

SPX-WEEKLY

SPX-DAILY LONGER TIMEFRAME

SPX-DAILY LINE

SPX-DAILY I

SPX-DAILY II

SPX-DAILY III

SPX-30MIN LONGER TIMEFRAME

SPX-5MIN

Thursday, March 29, 2012

Wednesday, March 28, 2012

AAPL, IBM, UKX (FTSE) & SPX

AAPL-DAILY

- Apple still on my radar and it is closely being monitored for a drastic drop.

- Tomorrow could be the start of the big drops for Apple (I will not hold my breath though).

IBM-DAILY

UKX (FTSE)-DAILY

SPX-DAILY LONGER TIMEFRAME

SPX-DAILY LINE

SPX-DAILY I

SPX-DAILY II

SPX-DAILY III

SPX-30MIN LONGER TIMEFRAME

SPX-5MIN

- Apple still on my radar and it is closely being monitored for a drastic drop.

- Tomorrow could be the start of the big drops for Apple (I will not hold my breath though).

IBM-DAILY

UKX (FTSE)-DAILY

SPX-DAILY LONGER TIMEFRAME

SPX-DAILY LINE

SPX-DAILY I

SPX-DAILY II

SPX-DAILY III

SPX-30MIN LONGER TIMEFRAME

SPX-5MIN

Tuesday, March 27, 2012

Monday, March 26, 2012

SPX

As the market continues its never ending push up, I expect a fast and big reversal to take place. But that said, you can't fight the market but go along with it. Fast plays is the way to go. To be completely bullish or bearish at this time is mistake in my opinion. I don't believe in overbought and oversold. The market can keep going up for a very long time regardless of what the technicals say. This is not because of "manipulation" but just the normal irrationality of the market.

Daytrading remains the best option to avoid any surprises (which is going to happen). So pay attention to my 5min chart.

SPX-DAILY LINE

SPX-DAILY I

SPX-DAILY II

SPX-30MIN LONGER TIMEFRAME

SPX-5MIN

Daytrading remains the best option to avoid any surprises (which is going to happen). So pay attention to my 5min chart.

SPX-DAILY LINE

SPX-DAILY I

SPX-DAILY II

SPX-30MIN LONGER TIMEFRAME

SPX-5MIN

Saturday, March 24, 2012

SPX WEEKEND REVIEW

Check back over the weekend for any updates.

SPX-WEEKLY

SPX-DAILY LONGER TIMEFRAME

SPX-DAILY LINE

SPX-DAILY I

SPX-DAILY II

SPX-30MIN LONGER TIMEFRAME

SPX-5MIN

SPX-WEEKLY

SPX-DAILY LONGER TIMEFRAME

SPX-DAILY LINE

SPX-DAILY I

SPX-DAILY II

SPX-30MIN LONGER TIMEFRAME

SPX-5MIN

Subscribe to:

Comments (Atom)