The bulls are buying time and now on borrowed time. The market is going to drop. Momentum is building for a drop (short-term). I have a 2week plan for the market which the bulls are trying to frustrate by holding their ground and making the market move sideways. But I expect the plan to come to fruition. The price actions on Thursday and Friday are exactly what I had been hoping to see for over a week in order to confirm the first 2 days of the 2week plan (i.e 10 market days). For it to continue on track, I need to see 2 more boring DOWN days on Tuesday and Wednesday just like yesterday's (Friday's) price action. More details of my expectation will be given after the close of each day. If it stays on track, expect a huge drop on Thursday.

Look for big down this week and the first half of next week with a short-term bottom on Wednesday January 11th and an upside bounce starting on Thursday January 12th.

Note that my expectation is not my trading. So, pay attention to my daily updates and comments with Entry, Target and Stop Loss because that is what my trading is based on. I only do what the charts say (Entry, Target & Stop Loss) not what I expect.

FOR TUESDAY: (mkt close on Monday)

Look for a tiny down day of about 3-5 points just like Friday's action with an open at the highs and close at the lows.

VIX-DAILY

SPX-MONTHLY

SPX-WEEKLY

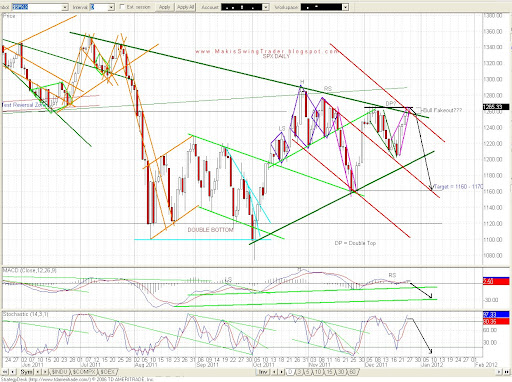

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

Enlarge any chart by clicking on it.

Unless otherwise specified, ALWAYS use the 15min chart to enter my recommended plays because

CONFIRMATION is a MUST. In other words, you need to see a 15min candlestick that CLOSES beyond

the entry point, then enter when it moves 10cents after the high/low of that candlestick.

Unless otherwise specified, ALWAYS use the 15min chart to enter my recommended plays because

CONFIRMATION is a MUST. In other words, you need to see a 15min candlestick that CLOSES beyond

the entry point, then enter when it moves 10cents after the high/low of that candlestick.

Saturday, December 31, 2011

Thursday, December 29, 2011

SPX - READY TO RESUME THE DOWNSIDE TOMORROW.

Look for a drop tomorrow with a move below 1258. It could be a big drop. The only limiting factor for a big drop is the fact that there might not be many participants (low volume) given that it's a 3day-weekend and it's Friday. But keep in mind that low volume doesn't say much because there can be exaggerated moves on low volume. That is why I don't focus on volume unless at key points if at all.

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

Wednesday, December 28, 2011

Tuesday, December 27, 2011

SPX - ANOTHER LOUSY DAY COMING TOMORROW. (PREPARE FOR A DROP )

Two more boring down days before a big drop on Friday and next week.

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

Saturday, December 24, 2011

VIX, RUSSELL & SPX - THE MARKET IS GOING TO ROLL OVER (3 BORING DOWN DAYS AHEAD)

BULL FAKEOUT IN PLAY

The market is going to drop short-term for 2weeks (I don't care about long-term). I'm not talking about Bull or Bear market but the next swing. Look for 3 boring down days of tiny moves (about 4-5pips/day on the SPX) before the major part of the selloff. Over this 2weeks period, I will post what I think will happen the next day. I will start doing that only after I see the first down day (very likely on Tuesday - mkt close on Monday).

VIX-DAILY

RUSSELL-DAILY (RUSSELL IS A MARKET LEADER - PAY ATTENTION TO THE SLOWDOWN TAKING PLACE)

SPX-WEEKLY

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

The market is going to drop short-term for 2weeks (I don't care about long-term). I'm not talking about Bull or Bear market but the next swing. Look for 3 boring down days of tiny moves (about 4-5pips/day on the SPX) before the major part of the selloff. Over this 2weeks period, I will post what I think will happen the next day. I will start doing that only after I see the first down day (very likely on Tuesday - mkt close on Monday).

VIX-DAILY

RUSSELL-DAILY (RUSSELL IS A MARKET LEADER - PAY ATTENTION TO THE SLOWDOWN TAKING PLACE)

SPX-WEEKLY

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

Wednesday, December 21, 2011

SPX - LOOK FOR A PUSH TO 1260-1265 AND A CLOSE AT THE HIGHS TOMORROW.

If SPX moves above 1246, look for a big rise tomorrow with a close at the highs of the day (about 1260-1265). So the upside target for tomorrow will be the close of the day whether it falls short, gets to or exceeds the 1260-1265. Therefore, I will exit my Calls/long few minutes before the close and then enter Puts/short because I expect about 3days of small drops (about 8points/day) starting on Friday before big drops come in likely starting next week on Thursday 29th. (US mkt will be close on Monday 26th).

Stop Loss for the Put/short play (or new Call/long play entry) will be posted after the close because I need to see the closing price to know the Stop Loss point (or new bullish entry point).

Note that this information is my OPINION/EXPECTATION but I do what the CHARTS tell me to, not my opinion/expectation, though I'm confident about my expectation (as always, but I could be completely wrong).

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

Stop Loss for the Put/short play (or new Call/long play entry) will be posted after the close because I need to see the closing price to know the Stop Loss point (or new bullish entry point).

Note that this information is my OPINION/EXPECTATION but I do what the CHARTS tell me to, not my opinion/expectation, though I'm confident about my expectation (as always, but I could be completely wrong).

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

Tuesday, December 20, 2011

SPX

After a huge day, the market usually tends to follow with a tiny day (up or down).

Though tomorrow is most likely going to be a tiny (down) day based on history, I believe it will be a big up day of about 20-25points to take price to 1260-1265 before the drop starts and picks up speed next week.

IF SPX GETS TO 1260-1265, LOAD UP ON PUTS/SHORTS BECAUSE THAT LEVEL WILL NOT BE SEEN AGAIN FOR A WHILE (NOT FOR A MONTH AT LEAST). Stop Loss point will be mentioned after the close tomorrow if it gets to 1260-1265.

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

Though tomorrow is most likely going to be a tiny (down) day based on history, I believe it will be a big up day of about 20-25points to take price to 1260-1265 before the drop starts and picks up speed next week.

IF SPX GETS TO 1260-1265, LOAD UP ON PUTS/SHORTS BECAUSE THAT LEVEL WILL NOT BE SEEN AGAIN FOR A WHILE (NOT FOR A MONTH AT LEAST). Stop Loss point will be mentioned after the close tomorrow if it gets to 1260-1265.

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

Monday, December 19, 2011

SPX

SPX continues the downward drift (correction), but it will explode to the upside (likely tomorrow) to fakeout both Bulls and Bears before the run down. This correction has been longer than anticipated both in time and price. This is an indication of upside momentum building for an explosive and short upside move lasting a day or so, in order to shake up everyone by consuming most of the downward drift.

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

Saturday, December 17, 2011

Thursday, December 15, 2011

Wednesday, December 14, 2011

SPX NOT READY FOR A DROP YET. BEAR FAKEOUT MOVE IN EFFECT.

Strong run up coming. Bear fakeout move taking place at the moment. Look for a strong push up for a bull fakeout before a sustained strong bear move.

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

Tuesday, December 13, 2011

SPX READY FOR A MOVE TO 1260 -1265 STARTING TOMORROW

Look for the SPX to move up starting tomorrow till 1260-1265 which I believe will be achieved on Friday to reach the top of Diamond Pattern.

Don't expect any significant run bullish or bearish yet. More sideways action ahead till the break down that will take place on the 27th (or 20th) for a significant drop.

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

Don't expect any significant run bullish or bearish yet. More sideways action ahead till the break down that will take place on the 27th (or 20th) for a significant drop.

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

Monday, December 12, 2011

SPX READY FOR A BOUNCE TOMORROW (OR STRONG BOUNCE ON WEDNESDAY)

Don't expect any decisive move yet. The market will keep moving sideways for the time being. Look for the SPX to make a bounce tomorrow (most likely) or a small down day that will be a setup for a strong move up on Wednesday. The bounce will take the SPX back to the top of the Diamond Pattern in play i.e 1260 - 1265.

I expect SPX to keep moving sideways in the Diamond Pattern till a BREAK LOWER occurs, which I believe will take place on the 20th (less likely) or 27th (very likely). Will be dealt with later.

SPX-DAILY

SPX-30MIN SHORTER TIMEFRAME (no LONGER TIMEFRAME chart today).

I expect SPX to keep moving sideways in the Diamond Pattern till a BREAK LOWER occurs, which I believe will take place on the 20th (less likely) or 27th (very likely). Will be dealt with later.

SPX-DAILY

SPX-30MIN SHORTER TIMEFRAME (no LONGER TIMEFRAME chart today).

Saturday, December 10, 2011

SPX WEEKEND REVIEW

Expect the sideways action to continue within the price range of 1245-1265. See the note on the Daily chart for more information.

I believe a break down will occur on the 20th (less likely) or 27th (very likely). The exact date will be dealt with later. Not important at this time but get ready.

SPX-WEEKLY

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

I believe a break down will occur on the 20th (less likely) or 27th (very likely). The exact date will be dealt with later. Not important at this time but get ready.

SPX-WEEKLY

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

Thursday, December 8, 2011

SPX - NO BREAKDOWN YET. BEAR FAKEOUT IN PLAY.

BEAR FAKEOUT ALERT. Look for a move back into and maintenance of the 1245 - 1265 range. No breakdown yet.

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

SPX-DAILY

SPX-30MIN LONGER TIMEFRAME

SPX-30MIN SHORTER TIMEFRAME

Subscribe to:

Comments (Atom)